2024 Q1 Technology Services M&A Market Report The technology services M&A market in 2023 faced challenges amid economic uncertainties, leading to a 21% drop in deal volume from 2022. However, the demand for digital transformation remained strong, particularly in cloud computing, cybersecurity, and AI, driving acquisitions. Private equity played a significant role, adding competitive pressure …

The experienced M&A Advisors and Intermediaries at BMI Mergers & Acquisitions have consistently delivered quality service and leading industry knowledge for over 35 years. The members of our team have first-hand experience dealing with the challenges and opportunities of owning, selling, or merging a business. These qualities are what drive us toward continued excellence and set us apart from the competition.

Tax Considerations for Selling a Business

How much a business owner keeps from the sale of their company is a key question, and taxes are the primary factor. Below is a high-level overview of the major tax considerations applicable to most business sales.

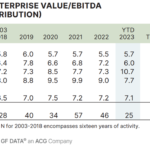

2023 Review: Distribution M&A Valuations

GF Data® reported on the Distribution business acquisition deal data for YTD December 2023 and while valuations are holding steady, deal volume is down 25-30% vs 2022. The decline in volume is not surprising, given the high cost of debt. However, the fact that valuations appear to be holding steady is, on the surface, surprising. Yet, when considering that perhaps only the best businesses are selling, and if valuations truly remained constant, we would expect to see an increase in multiples.

Preparing To Sell Your Business

Key Considerations for Improving Value When Preparing to Sell Your Business Deciding to sell your business is one of the most important decisions you’ll ever make as a business owner. It represents the culmination of your hard work and dedication. As you approach this significant milestone, several key factors require careful consideration. The goal is …

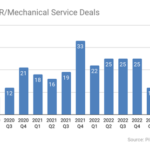

HVAC/R and Mechanical Services Q3 2023 Market Report

HVAC/R and Mechanical Services Q3 2023 Market Report: Buyer Interest Heating Up Pace of M&A Activity Expected to Resume After an M&A boom driven by a private equity buying frenzy that peaked in Q4 2021, U.S. HVAC/Refrigeration and other mechanical and facility service providers have seen an M&A slowdown so far in 2023. BMI sees …

HVAC/R and Mechanical Services Q3 2023 Market ReportRead More

Q2 2023 M&A Market Update: A Resilient Landscape

Q2 2023 M&A Market Update: A Resilient Landscape Introduction BMI has seen robust business acquisition activity from buyers and sellers in 2023, even though economic trends and credit availability remain uncertain. Our takeaway from all the data is that the positives outweigh the negatives, and while there are headwinds, the overall trend is one of …

Construction Industry Multiples (Revised June 2023)

Construction Industry Valuations and EBITDA Multiples EBITDA multiples are sometimes used to determine approximate business value in a sale transaction. Multiples can vary widely by industry and within industry segments. In recent years, we have also seen more higher end deals with multiples of 7 to 8 times EBITDA. The data tells us only premium …

Construction Industry Multiples (Revised June 2023)Read More

2023 Q1 Technology Services Market Report

2023 Q1 Technology Services Market Report In 2022, the technology services M&A market had mixed results, with lower middle-market deal volume and valuations decreasing by 10-15% and 20-25%, respectively. However, downturns historically present attractive opportunities for strategic acquisitions, and compressed valuations may make many deals too good to pass up. In 2023, private equity firms …

Construction Industry Insights

The backlog of profitable jobs is a critical factor in determining the valuation of a construction business. While a company’s value is derived from various factors, such as financial performance and assets, a contractor with little work on its backlog is not attractive to potential buyers. The absence of a healthy backlog can lead to a decrease in financial stability, bonding capacity, and skilled workers, which could cause the business’s value to plummet. Contractors must bid competitively but profitably and maintain stable operations to keep work on the backlog. This approach can help maintain valuation for the long haul and enable owners to focus on increasing their business’s worth.

2023 Business Acquisitions Outlook

2023 Business Acquisitions Outlook Lower Middle Market Business Sales I. Where Are We Coming From – 2021-2022 The best time to sell a privately held business were the years 2021-2022, as valuations and deal volumes reached a peak not seen over the previous 20 years. We looked at data on five industries and found that …

Construction Contractors: 10 Ways to Increase Your Company’s Valuation Before Selling

Despite the economic headwinds of higher interest rates and inflation, the construction sector continues to see steady merger & acquisition activity. Construction companies tend to sell for 3.5x to 7x EBITDA depending on the company’s size and other qualitative factors which can often be improved prior to selling. Here are ten actions an owner can take to prepare the company for presentation to the market and increase the potential buyer’s offer price.

Construction Contractors: 10 Ways to Increase Your Company’s Valuation Before SellingRead More

Semiconductor 2022 M&A Deal Activity Mixed Amid Regulatory and Supply Issues

Merger and Acquisition activity in the semiconductor industry is currently mixed due to regulatory and supply issues. While some companies are looking to acquire competitors to increase their market share and technological capabilities, others are holding off due to concerns about regulatory scrutiny and uncertainty around global supply chains.

Semiconductor 2022 M&A Deal Activity Mixed Amid Regulatory and Supply IssuesRead More