Greyson Tavolacci Originally from Atlanta, GA, Greyson Tavolacci relocated to Raleigh, NC in 2005. Beginning his professional career in commercial real estate brokerage, Greyson assisted in guiding business owners through leasing, acquisition, and asset disposition. His team orchestrated …

Award Winning Wine & Beverage Manufacturer/Wholesaler

Award Winning Wine & Beverage Manufacturer/Wholesaler Winery located in the Mid-Atlantic Region with over 20 years of producing award-winning products, earning Double Gold Medals from numerous competitions. They have a substantial wholesale operation and full end-to-end consumer retail …

Award Winning Wine & Beverage Manufacturer/Wholesaler Read More

Northeast Metal Recycling Company

Growing Northeast Metal Recycling Company This family-owned, Northeast metal recycling company was founded over 50 years ago to process non-ferrous metals. The original owner’s family would eventually sell the business to its currentowner. Under new leadership, the company’s offerings grew to …

BMI Facilitates the Sale of Custom Metal Fabricator, SmitHahn Company

BMI Assists in the Sale of another Metal Fabrication & Mechanical Contracting Business Allentown, PA — BMI Mergers & Acquisitions, a middle-market investment bank, is pleased to announce the successful sale of SmitHahn Company Inc., a respected mechanical contractor, to the investor group …

BMI Facilitates the Sale of Custom Metal Fabricator, SmitHahn CompanyRead More

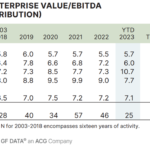

2023 Review: Distribution M&A Valuations

2023 in Review: Distribution M&A Valuations GF Data® reported on the Distribution business acquisition deal data for YTD December 2023 and while valuations are holding steady, deal volume is down 25-30% vs 2022. The decline in volume is not surprising, given the high cost of debt. However, …

BMI Mergers & Acquisitions announced the sale of Ideametrics to Smart ERP Solutions, Inc.

BMI Mergers & Acquisitions Assists Ideametrics in Sale to Smart ERP Solutions, Inc. Charlotte, NC – BMI announces the sale of its client, Ideametrics, a cloud consulting company to Smart ERP Solutions, Inc., a portfolio company of Third Century. Headquartered in New …

BMI Mergers & Acquisitions announced the sale of Ideametrics to Smart ERP Solutions, Inc.Read More