Sell Your Business with Confidence & Maximize Value

M&A Advisors | Business Brokers | Investment BankersResults Driven Professionals – Meeting Your Goals

At BMI Mergers & Acquisitions, we help business owners sell their companies while maximizing business value through a confidential, strategic, and expertly managed process. We specialize in selling businesses with $3M-$150M in revenue, connecting owners with serious buyers—private equity firms, strategic acquirers, and high-net-worth individuals—across regional, national, and international markets. From business valuation to closing, we provide hands-on guidance at every step to help you achieve a successful exit.

Confidential – Secure Process For Your Protection

Our first priority is to protect your business. With our experience in dealing with all types of buyers, we identify and neutralize threats, and shield your employees, customers, and suppliers.

Custom Marketing Process

Tailored to Your Unique Business

Managing the Process: Successfully selling or acquiring a business requires focusing on every step, from initial planning to identifying qualified buyers, all the way through post-closing integration. Our experienced M&A Advisors manage the entire business sale process, allowing you to focus on running your business. This approach helps maximize business value and ensures successful transactions. There are three distinct phases comprising 15 steps:

Bill Gregory, Owner, Ecco/Gregory Inc.

The BMI Difference

The BMI Team

Our engagements are led and managed by seasoned veterans with up to 40 years of experience in business sale and acquisition. Our team includes investment bankers, brokers, and business managers who not only handle the buying and selling of businesses but also the post-closing integration.

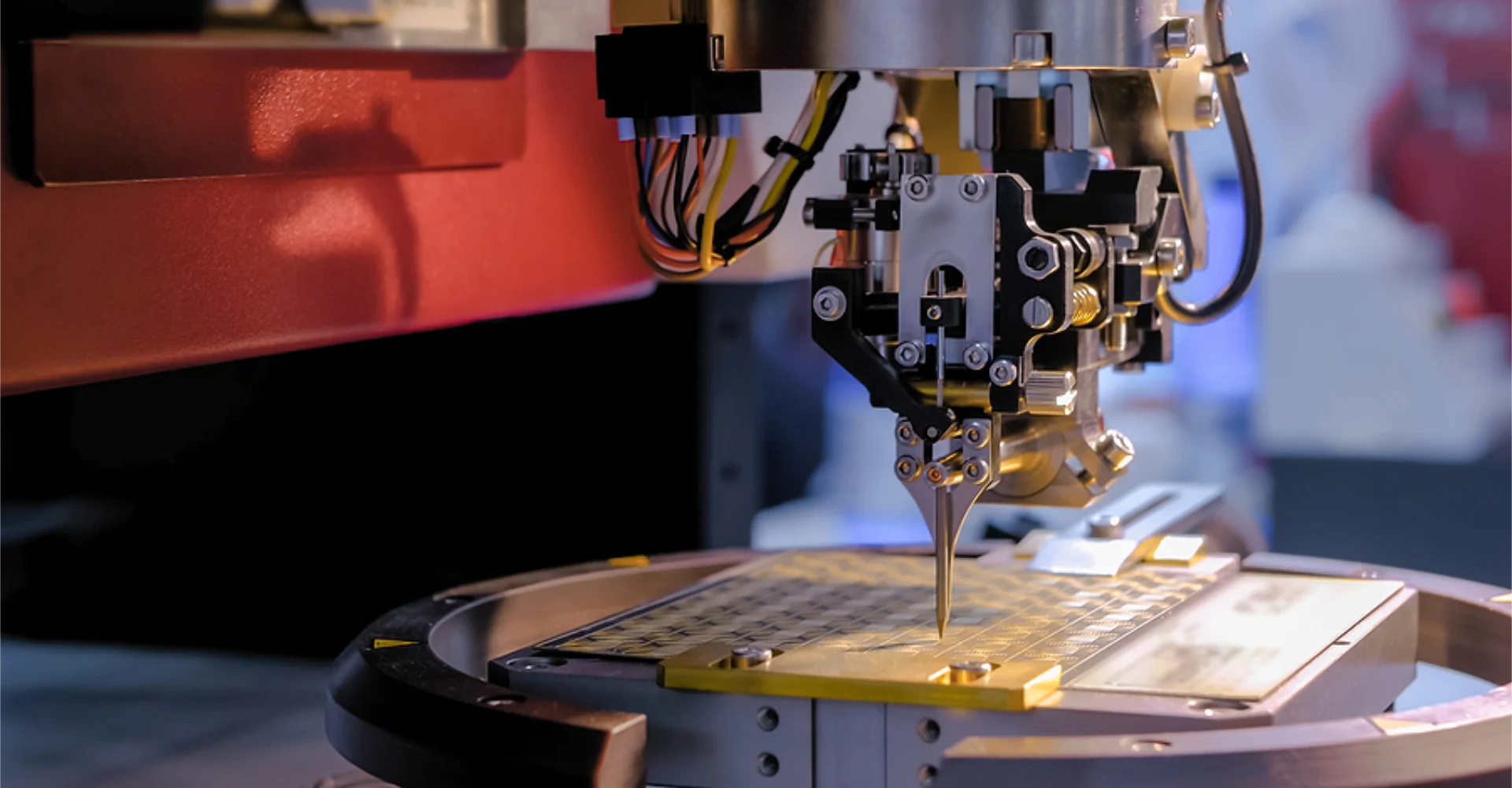

Our advisors have successfully built their own management consulting, growth consulting, ecommerce, and IT services businesses. They have experience across diverse industries, including electronics manufacturing and software. Some team members have worked at Fortune 500 companies such as Procter & Gamble, Arrow Electronics, Ford, Merrill Lynch, and Hershey Foods.

Certain advisors hold industry certifications such as M&AMI and CMAA, as well as FINRA registration Series 79 Limited Investment Banking* for M&A.

Our services

Sell-side advisory

Assisting business owners in the sale of their company, including finding buyers, marketing the business, obtaining offers, managing due diligence, and leading negotiations.

Buy-side advisory

We work with corporate strategic and private equity companies in implementing their growth through acquisition strategies and locating companies available for sale, including those not on the market.

Business Sale Preparation Advisory

Market valuations

Industries of Expertise

While we have sold businesses in many industries, the following are our areas of greatest depth and experience.

Most Recent News and Insights

Resources

Insights

Market reports