Market Reports

2024 M&A Deal Activity Flat with 2023 but Remains Strong Relative to Historic Levels PitchBook Data reports 2024 global M&A deal activity within the Electronic Parts & Equipment sector was essentially flat with 2023. The chart below outlines that 304 deals were reported in 2024 vs. 313 in 2023. Capital Invested (Deal Value) on the…

A Surge in Connections: Electrical Contractor M&A Rebounds The U.S. electrical contracting sector rebounded in merger and acquisition (M&A) activity in 2024, following a slowdown in 2023. This resurgence reflects a return to more favorable economic conditions after a tough period of rising inflation, increasing interest rates, and economic uncertainty. Private Equity Platforms Powering Up…

Injection Molding M&A trends in 2024 show deal activity returning to pre-pandemic levels of 2019, though still below the post-COVID highs of 2021-2023. Strategic buyers remain dominant, but the lines continue to blur as many private equity firms own the strategics driving these investments. Deal Count – 10 Year History – Injection Molding VALUATIONS –…

In 2024, we observed a significant increase in M&A deal activity in the lower middle market for specialty trades contractors and, specifically, for heavy/civil construction contractors. In this update, we look back at year-over-year deal activity, including 2024 for heavy/civil contractors, share examples of recent deals, and consider what makes these companies attractive to buyers.…

While several business valuation methods exist, EBITDA multiples are frequently used to determine approximate business value in a sale transaction. Multiples can vary widely by industry and within industry segments, and the construction industry is no different. The data and experience tell us that only premium-quality businesses are achieving extraordinary valuations in the construction industry.…

The technology services M&A market in 2023 faced challenges amid economic uncertainties, leading to a 21% drop in deal volume from 2022. However, the demand for digital transformation remained strong, particularly in cloud computing, cybersecurity, and AI, driving acquisitions. Private equity played a significant role, adding competitive pressure and driving up valuations for companies with…

GF Data® reported on the Distribution business acquisition deal data for YTD December 2023 and while valuations are holding steady, deal volume is down 25-30% vs 2022. The decline in volume is not surprising, given the high cost of debt. However, the fact that valuations appear to be holding steady is, on the surface, surprising.…

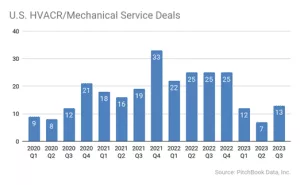

Buyer Interest Heating Up Pace of M&A Activity Expected to Resume After an M&A boom driven by a private equity buying frenzy that peaked in Q4 2021, U.S. HVAC/Refrigeration and other mechanical and facility service providers have seen an M&A slowdown so far in 2023. BMI sees demand heating up again after a cooling off…

Introduction BMI has seen robust business acquisition activity from buyers and sellers in 2023, even though economic trends and credit availability remain uncertain. Our takeaway from all the data is that the positives outweigh the negatives, and while there are headwinds, the overall trend is one of strengthening. Companies holding steady Company financials reflect a…

In 2022, the technology services M&A market had mixed results, with lower middle-market deal volume and valuations decreasing by 10-15% and 20-25%, respectively. However, downturns historically present attractive opportunities for strategic acquisitions, and compressed valuations may make many deals too good to pass up. In 2023, private equity firms are expected to be the primary…

Lower Middle Market Business Sales I. Where Are We Coming From – 2021-2022 The best time to sell a privately held business were the years 2021-2022, as valuations and deal volumes reached a peak not seen over the previous 20 years. We looked at data on five industries and found that all had peak valuations…

In the past two years, we saw a peak in valuations and deal volumes in the market, creating a seller’s market where deal terms were favorable. As we move into 2023, the macro-economic picture remains relatively strong, but interest rate increases and global events may create uncertainty. Buyers, especially private equity firms, are still actively…