Insights

Thinking About Acquiring Another Contractor to Grow Your Construction Business?

What to Know About Conducting a Targeted Acquisition Search and Six Steps to Close the Deal Acquiring another contractor can be one of the most effective ways to grow your business— especially when organic expansion slows or becomes less efficient. But like any major initiative, acquisitions require upfront planning, internal alignment, and the right search…

Equity vs. Earnout: What Business Sellers Need to Know

When selling your business, price isn’t the only thing that matters—how you get paid is just as important. In the lower middle market, deals are often structured with equity rollovers, earnouts, or a mix of both. Understanding these options can help you maximize value while minimizing risk. What Is an Equity Rollover? In an equity…

Tariff Impact: Service Business M&A Poised for Growth

Jane Marlowe, Senior M&A Advisor, BMI Mergers & Acquisitions Good news: the service sector, particularly businesses with inelastic demand profiles like facilities management, field services, and healthcare, is anticipated to see increased M&A activity due to announced U.S. tariffs. With lower tariff exposure compared to manufacturing, these businesses are becoming increasingly attractive targets, potentially commanding…

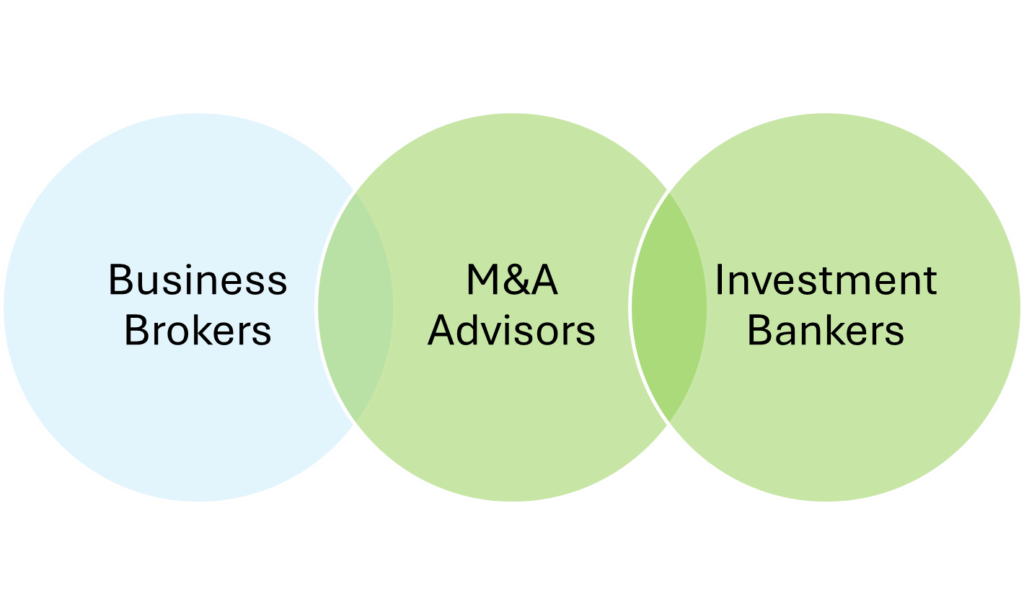

Business Broker vs M&A Advisor vs Investment Banker

An estimated 10,000 business intermediaries operate across the U.S., helping business owners sell their companies under various titles such as Business Broker or Investment Banker. As advisors in the lower middle market, we have been referred to as business brokers, advisors, and investment bankers by our clients and their attorneys and accountants, highlighting how these…

Selling Your Business – Consider Purchase Price Allocation Early in the Negotiations

Often, purchase price allocation is viewed as “something the accountants do” and is one of the last items discussed before closing the sale of a business. However, this is a mistake, as purchase price allocation (PPA) can significantly impact the value received and influence the negotiation strategy, as well as the future relationship between the…

Understanding Seller Financing in Business Sales

With over 20 years in M&A, I’ve seen the popularity of seller financing shift in response to economic conditions. Recently, with rising interest rates and cautious lending practices, seller notes have become more common. But what exactly are seller notes, and how should you approach them? What is Seller Financing? Seller financing, or a “seller…