Insights

Tax Considerations for Selling a Business

How much a business owner keeps from the sale of their company is a key question, and taxes are the primary factor. Below is a high-level overview of the major tax considerations applicable to most business sales.

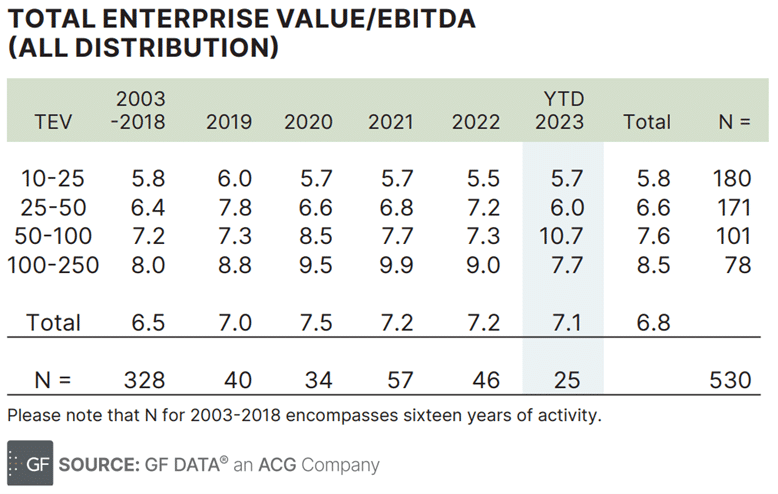

2023 Review: Distribution M&A Valuations

GF Data® reported on the Distribution business acquisition deal data for YTD December 2023 and while valuations are holding steady, deal volume is down 25-30% vs 2022. The decline in volume is not surprising, given the high cost of debt. However, the fact that valuations appear to be holding steady is, on the surface, surprising….

Preparing To Sell Your Business

Key Considerations for Improving Value When Preparing to Sell Your Business Deciding to sell your business is one of the most important decisions you’ll ever make as a business owner. It represents the culmination of your hard work and dedication. As you approach this significant milestone, several key factors require careful consideration. The goal is…

Construction Industry Multiples (Revised June 2023)

EBITDA multiples are sometimes used to determine approximate business value in a sale transaction. Multiples can vary widely by industry and within industry segments. In recent years, we have also seen more higher end deals with multiples of 7 to 8 times EBITDA. The data tells us only premium quality businesses are achieving extraordinary valuations…

Construction Industry Insights

The backlog of profitable jobs is a critical factor in determining the valuation of a construction business. While a company’s value is derived from various factors, such as financial performance and assets, a contractor with little work on its backlog is not attractive to potential buyers. The absence of a healthy backlog can lead to…

Construction Contractors: 10 Ways to Increase Your Company’s Valuation Before Selling

Despite the economic headwinds of higher interest rates and inflation, the construction sector continues to see steady merger & acquisition activity. Construction companies tend to sell for 3.5x to 7x EBITDA depending on the company’s size and other qualitative factors which can often be improved prior to selling. Here are ten actions an owner can…