Insights

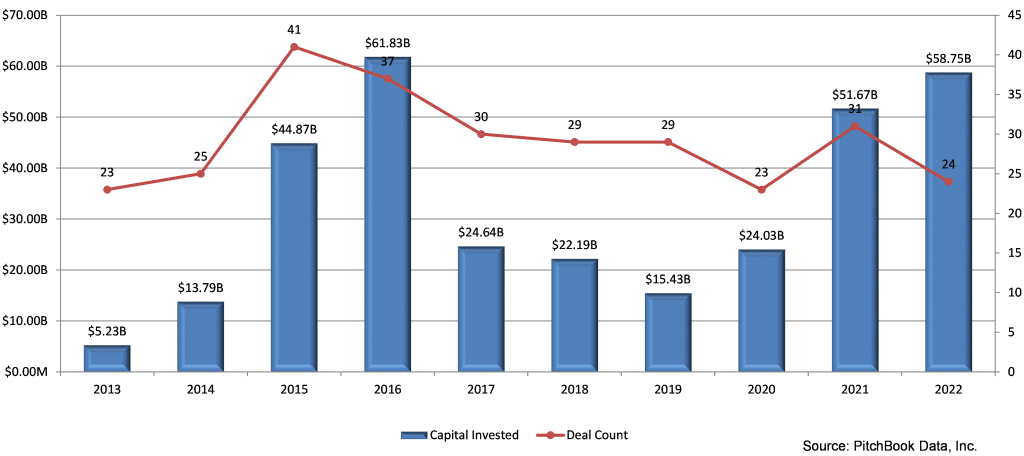

Semiconductor 2022 M&A Deal Activity Mixed Amid Regulatory and Supply Issues

Merger and Acquisition activity in the semiconductor industry is currently mixed due to regulatory and supply issues. While some companies are looking to acquire competitors to increase their market share and technological capabilities, others are holding off due to concerns about regulatory scrutiny and uncertainty around global supply chains.

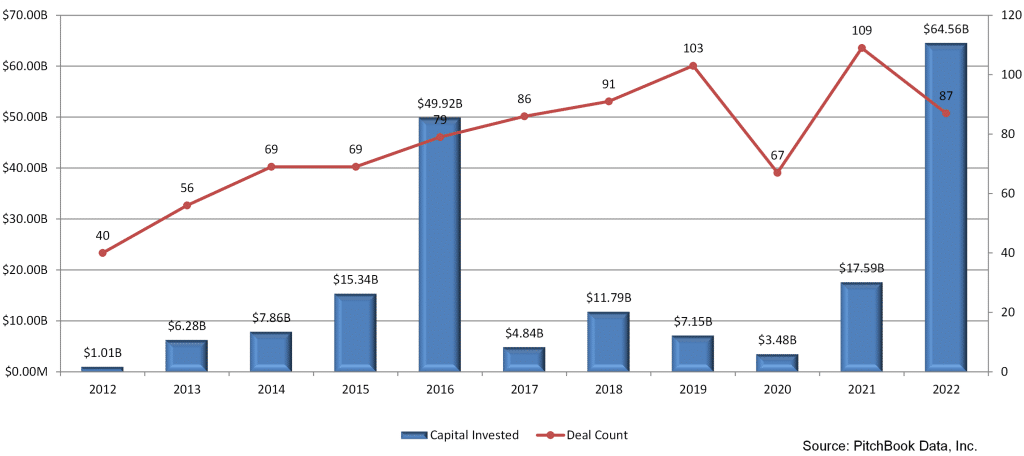

Q4 2022 Electronic Components, Equipment & Instruments Deal Activity

The current state of the electronic components, equipment, and instruments industry. This report highlights the diversity of sub-industries that make up the sector and the growth opportunities created by the increasing importance of technology in different fields. Additionally, the challenges facing the industry, including supply chain disruptions and regulatory issues, and the impact of recent…

Case Study: How a Higher Ed Focused Software Company Found the Right Buyer

Introduction Aviso Retention is a student retention software solution for higher education. It uses AI and predictive analytics to help colleges and universities increase the engagement, retention, and degree or certificate completion of underserved students. Alex Leader founded Aviso in 2012. Within less than a decade, he and his team had bootstrapped it into a…

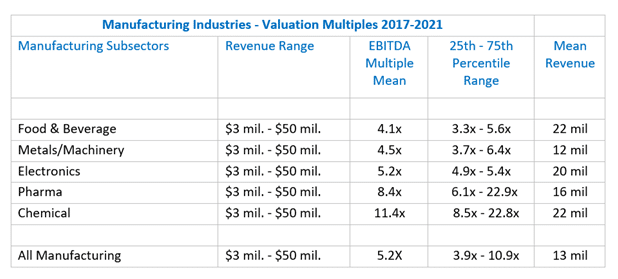

Valuation Multiples for the Manufacturing Industry

Manufacturing company valuations are often discussed in terms of multiples of EBITDA. This is because EBITDA is a common measure of a company’s cash flow that allows apples-to-apples comparisons between companies with different capital structures. We looked at manufacturers sold in the past five years, included breakouts for a few key manufacturing sectors, and summarized…

Identifying Code Risks in Software M&A

Strategic fit and table stakes KPIs aren’t the only things acquirers evaluate during the software M&A process. A software code review is one of the many components that is often overlooked by sellers. Learn more about Matt Tortora.

Concentration Can Significantly Impact Valuations For Lower Middle Market Electronic Businesses

Many privately owned electronic businesses operating in the lower middle market can exhibit concentration in either the selling channel, the supply channel, or both. When the time comes to sell the business, what historically has been viewed as an area of strength by business owners can instead be considered a risk for potential buyers. Concentration…