Insights

SaaS KPIs That Matter Most to Investors & Acquirers

There are over a dozen KPIs (key performance indicators) investors, and acquirers rely on when evaluating an investment or acquisition. Optimizing these metrics provides SaaS companies with a path to sustainable growth and puts them in a position to raise growth capital or successfully exit. This deck offers founders and CEOs an overview of what…

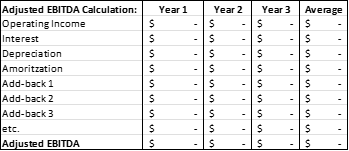

Add-Backs To EBITDA Can Substantially Increase Business Valuations

EBITDA is an abbreviation for “earnings before interest, taxes, depreciation, and amortization.” It is calculated by taking operating income and adding back to it; interest, depreciation, and amortization expenses. EBITDA is a key metric widely used by financial and investment professionals operating in the lower-middle market to analyze a company’s operating profitability and estimate valuations….

Planning to Sell Your Business in a Time of Uncertainty

Many private businesses survived the pandemic crisis of 2020 and have now stabilized, but for others, the perfect storm is still raging. How can business owners ensure the survival of their businesses and the ultimate positioning of their business for sale? Questions many business owners are asking BMI advisors: Should I sell my business in…

Selling Your Business With a PPP Loan

SBA Rules for PPP Loans in Business Ownership Changes Many M&A transactions since April 2020 have involved a PPP loan held by the selling company. Parties have often been unsure of the impact of a sale or partial sale on the forgiveness of the loan. On October 2, 2020, the SBA issued rules for business…

Positioning Your IT Services Firm for a Successful Exit

I often speak with CEOs and business owners in the IT services space who are beginning to think about an eventual exit plan but are still a few years out from starting that process. And the question I am often asked is “What are buyers looking for, and how can I best prepare for a…

BMI’s M&A Advisor and Information Technology Industry Specialist Obtains the Series 79

Monday, August 17, 2020 – (Chicago, IL) – BMI Mergers & Acquisitions, an M&A and business brokerage firm, announced Matthew Tortora successfully completed the exams and requirements for the FINRA series 79 (Investment Banking Representative) and 63 (Uniform Securities Agent State Law) registrations. This brings an additional level of professionalism and protection for his clients…