Market Reports

2023 Review: Distribution M&A Valuations

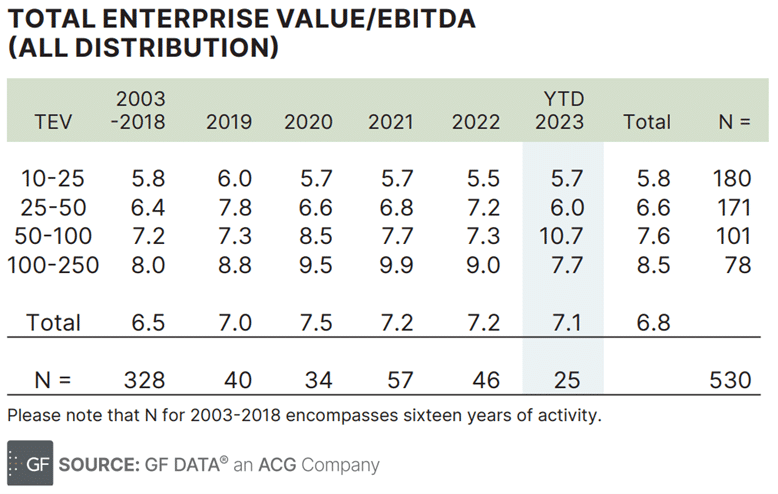

GF Data® reported on the Distribution business acquisition deal data for YTD December 2023 and while valuations are holding steady, deal volume is down 25-30% vs 2022. The decline in volume is not surprising, given the high cost of debt. However, the fact that valuations appear to be holding steady is, on the surface, surprising….

HVAC/R and Mechanical Services Q3 2023 Market Report

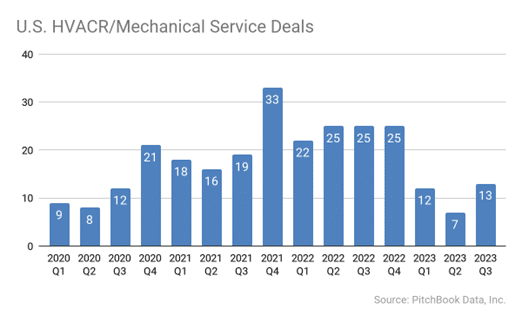

Buyer Interest Heating Up Pace of M&A Activity Expected to Resume After an M&A boom driven by a private equity buying frenzy that peaked in Q4 2021, U.S. HVAC/Refrigeration and other mechanical and facility service providers have seen an M&A slowdown so far in 2023. BMI sees demand heating up again after a cooling off…

Q2 2023 M&A Market Update: A Resilient Landscape

Introduction BMI has seen robust business acquisition activity from buyers and sellers in 2023, even though economic trends and credit availability remain uncertain. Our takeaway from all the data is that the positives outweigh the negatives, and while there are headwinds, the overall trend is one of strengthening. Companies holding steady Company financials reflect a…

Q1 2023 Technology Services Market Report

In 2022, the technology services M&A market had mixed results, with lower middle-market deal volume and valuations decreasing by 10-15% and 20-25%, respectively. However, downturns historically present attractive opportunities for strategic acquisitions, and compressed valuations may make many deals too good to pass up. In 2023, private equity firms are expected to be the primary…

Download2023 Business Acquisitions Outlook

Lower Middle Market Business Sales I. Where Are We Coming From – 2021-2022 The best time to sell a privately held business were the years 2021-2022, as valuations and deal volumes reached a peak not seen over the previous 20 years. We looked at data on five industries and found that all had peak valuations…

2023 Business Acquisitions: The Middle Market M&A Outlook

In the past two years, we saw a peak in valuations and deal volumes in the market, creating a seller’s market where deal terms were favorable. As we move into 2023, the macro-economic picture remains relatively strong, but interest rate increases and global events may create uncertainty. Buyers, especially private equity firms, are still actively…