Insights

Key Considerations for Improving Value When Preparing to Sell Your Business Deciding to sell your business is one of the most important decisions you’ll ever make as a business owner. It represents the culmination of your hard work and dedication. As you approach this significant milestone, several key factors require careful consideration. The goal is…

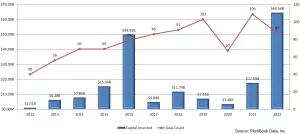

EBITDA multiples are sometimes used to determine approximate business value in a sale transaction. Multiples can vary widely by industry and within industry segments. In recent years, we have also seen more higher end deals with multiples of 7 to 8 times EBITDA. The data tells us only premium quality businesses are achieving extraordinary valuations…

The backlog of profitable jobs is a critical factor in determining the valuation of a construction business. While a company’s value is derived from various factors, such as financial performance and assets, a contractor with little work on its backlog is not attractive to potential buyers. The absence of a healthy backlog can lead to…

Despite the economic headwinds of higher interest rates and inflation, the construction sector continues to see steady merger & acquisition activity. Construction companies tend to sell for 3.5x to 7x EBITDA depending on the company’s size and other qualitative factors which can often be improved prior to selling. Here are ten actions an owner can…

Merger and Acquisition activity in the semiconductor industry is currently mixed due to regulatory and supply issues. While some companies are looking to acquire competitors to increase their market share and technological capabilities, others are holding off due to concerns about regulatory scrutiny and uncertainty around global supply chains.

The current state of the electronic components, equipment, and instruments industry. This report highlights the diversity of sub-industries that make up the sector and the growth opportunities created by the increasing importance of technology in different fields. Additionally, the challenges facing the industry, including supply chain disruptions and regulatory issues, and the impact of recent…

Introduction Aviso Retention is a student retention software solution for higher education. It uses AI and predictive analytics to help colleges and universities increase the engagement, retention, and degree or certificate completion of underserved students. Alex Leader founded Aviso in 2012. Within less than a decade, he and his team had bootstrapped it into a…

Manufacturing company valuations are often discussed in terms of multiples of EBITDA. This is because EBITDA is a common measure of a company’s cash flow that allows apples-to-apples comparisons between companies with different capital structures. We looked at manufacturers sold in the past five years, included breakouts for a few key manufacturing sectors, and summarized…

Strategic fit and table stakes KPIs aren’t the only things acquirers evaluate during the software M&A process. A software code review is one of the many components that is often overlooked by sellers. Learn more about Matt Tortora.

Many privately owned electronic businesses operating in the lower middle market can exhibit concentration in either the selling channel, the supply channel, or both. When the time comes to sell the business, what historically has been viewed as an area of strength by business owners can instead be considered a risk for potential buyers. Concentration…

There are over a dozen KPIs (key performance indicators) investors, and acquirers rely on when evaluating an investment or acquisition. Optimizing these metrics provides SaaS companies with a path to sustainable growth and puts them in a position to raise growth capital or successfully exit. This deck offers founders and CEOs an overview of what…

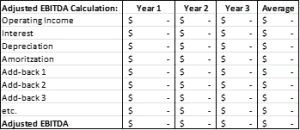

EBITDA is an abbreviation for “earnings before interest, taxes, depreciation, and amortization.” It is calculated by taking operating income and adding back to it; interest, depreciation, and amortization expenses. EBITDA is a key metric widely used by financial and investment professionals operating in the lower-middle market to analyze a company’s operating profitability and estimate valuations.…